Post Statistics

This post has 1111 words.

This post has 6966 characters.

This post will take about 5 minute(s) to read.

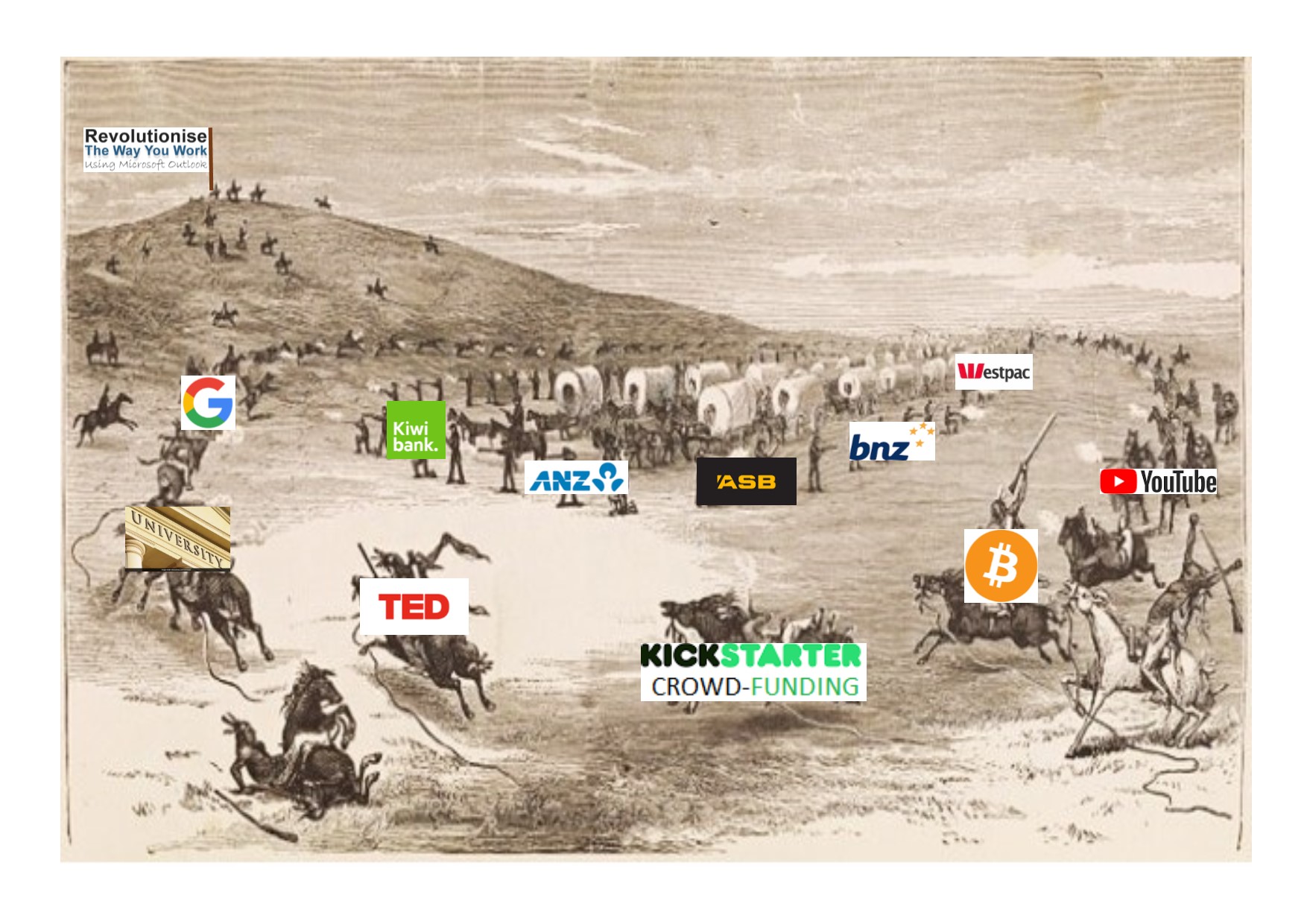

While there are always complaints about “disruptive technology”, in mankind’s journey this is nothing new as there have been many examples over time. Starting with people dragging goods by sled, which is labour-intensive, until mankind invented the wheel. For 100’s of years there was an honourable profession of artists who would record an image of a person or scene, then along came the camera and many artists were no longer required. For 100’s of years, there was an honourable profession of hand-written books by scribes, and then along came the printing press. Until evolutionary technology was invented, the transport, art and scribing industry was all controlled by the professions. However, evolutionary technology takes control away from Industry and gives it to the people.

In a previous blog, I talked about how Religion controlled Education until Education came into its own and technical institutes then controlled the industries with the creation of digital technology and Social Media. Now, teaching faculties have lost some control of the industry because people go to Google or YouTube to learn what they require, unrestrained by the limits and costs of teaching institutions. With the invention of the coin, financial institution-controlled currency and the Banking industry was created. While Banks have controlled our Economy for many centuries, technology is now available that supersedes their direct influence in the form of Bitcoin, crowd-funding, etc.

In the 1980s, I went on an ocean cruise where a team of Westpac banking executives had been sent to design a strategy for the implementation of mobile banking. While it was clever at the time, other Banks soon followed in the development of online banking, the result was that people had no need to go to a branch or be physically present at a bank as “automated” is now bank approval for lending. In today’s world, Banks cannot survive by doing what they have done in the past, they need to find a way to stay in touch and interact in more meaningful ways with their high-value customers. Modern Banking technology enables the Bank, through data-mining, to identify their customers who are morphing into commercially-savvy individuals and to retain them, they need to develop more meaningful ways to interact with them.

As people move through life’s journey, starting with a person’s market-related education and passage to adulthood, they choose a career and participate as an employee or by self-employment. Once they start a family so begins the long haul of raising children. During this period, one of the partners could potentially look at starting their own business. At the birth of their 2nd Adulthood, the 50’s, they may have a mid-life crisis as the male or female menopause arrives which again can lead to a desire for self-employment. Throughout this journey, Banks need to provide financial support via their products and services which needs to go far beyond what they currently supply because as they are, they are falling short of what modern society requires. As an example, BNZ have created “Customer Centres” where their business-owner clients can run staff, client meetings and conferences and training workshops within their premises. This falls short as of most of NZ’s SME’s of less than $2 million turnover don’t have the budgets for staff or leadership and/or business-owner development. This allows organisations like Icehouse to come to the rescue, and through their intervention, are able they pick off the various Banks’ business customers and deliver what the Banks should be providing themselves to keep and develop their commercially savvy high-value customers.

To survive, Banks need to step up and become the biggest influencer of the SME economy, which makes up 97% of the NZ Economy.

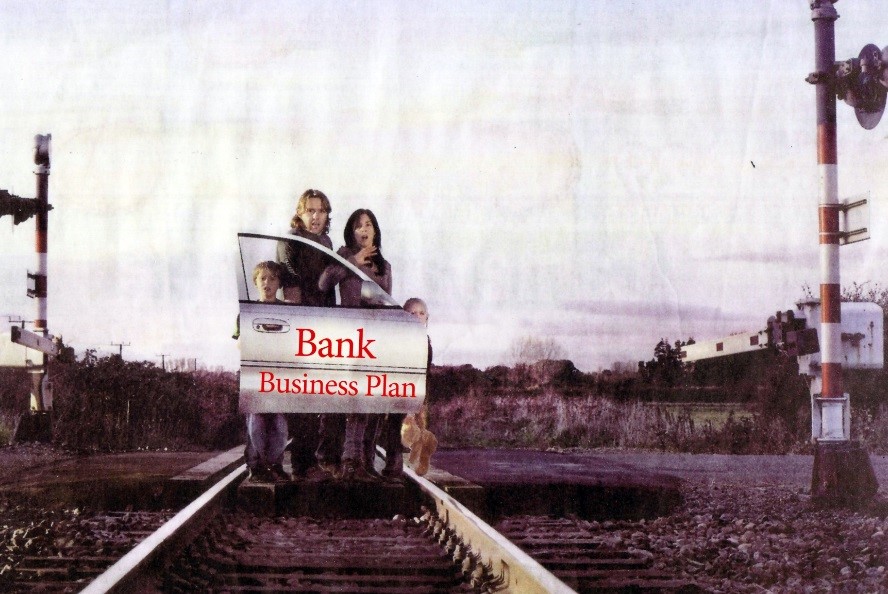

Sadly, Banks are way behind the eight-ball because of their conservative tick-box interventions approach where they willingly lend money to people who want to start their own business by insisting on using their family home, bricks and mortar, as security. It is morally corrupt that Banks lend money using the family home as security when it is common knowledge that 80% of business in the start-up form fail in the first 5 years. While Banks insist on the person to provide a business plan they do not provide support that ensures the customer implements the plan successfully because that would cost money and Banks are there to earn money to meet shareholder requirements.

“Banks believe a business plan is enough of an intervention”

The reason for the high fail rate is that, according to Malcolm Gladwell in his book Outliers, people require 10,000 hours to gain mastery of an industry or profession. When a person moves out of a technical role and salary to start their own business with an unfamiliar set of skills and demands, then a lot of families pay the price when the Bank forecloses.

Conservatism is the Achilles’ heel of Banks because they offer the same products and services and many Banks use the same sales-training methodology so that they don’t step outside of industry norms. When a Bank employee is sent to interact with a commercially-savvy customer that the Bank’s data-mining has identified as a high-value client they need to retain, the employee is expected to differentiate themselves from their competitors. The poor bank employee is doomed before they start.

John Key moved out of international finance to become our Prime Minister. In the middle of the Global Financial Crisis, his by-line was “I’m going to run this country like a business” which he did and gave us a Rock Star-economy. I wonder, if as Chairman of ANZ, will he guide the Bank to be run as a country, with the appropriate social conscience and foresight to create a Rock Star-financial institution?

I wonder which Bank will be the first to drop the Product/Feature/Benefit-sales push model and start using the consultative counselling approach? When Banks insist upon using the family home as security to lend money on a business opportunity, they stop monitoring the business loan performance using the bank statement monthly/quarterly against the business plan because that is too late. A more socially-appropriate approach would be to still use the family home as security, have the borrower write a business plan, but then they have to create an implementation plan which focuses on the Key Result Areas that drive the success of the business. Then the borrower sends out weekly reports to the Bank as set out in my book Revolutionise the Way You Work. In it, I show how we already have the technology we need to revolutionise the way people work and how Banks could and should be the biggest influencer in our economy